-

Recent Posts

-

Follow Us

-

Archives

- May 2023

- October 2022

- July 2022

- April 2021

- August 2020

- July 2020

- July 2019

- June 2019

- January 2019

- December 2018

- September 2018

- August 2018

- June 2018

- April 2018

- February 2018

- January 2018

- August 2017

- July 2017

- April 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- September 2014

- August 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- October 2013

- September 2013

- June 2013

- May 2013

-

-

Categories

Tags

accountability admissions application Business Because business school CAT CAT Mock Test CET CFA CFA study schedule CPA entrepreneurship free study material gmat GMAT goal score gmat study partner gmat tutor gre INSEAD interview Ivy League linkedin LSAT magoosh MBA MBA entrance exam MCAT study partner mock test motivation practice questions recipe snacks start-up study study buddy study group studypal study partner study spots Study Tips superfood syllabus test prep time mamangement TimePrep

CPA – These three simple initials after your name makes you one in a million in the finance and accounting fraternity. You feel proud to belong to the most elite group of the world’s topmost Public Accountants.

Being a CPA doesn’t only mean that you are a qualified professional accountant, it means much more than that. A CPA degree after your name makes your career opportunities as vast as the corporate world can be. You get globally mobile. You are unanimously trusted as an international finance professional with high calibres and you are eligible to fill in any respectful position of the industry. Most CFos and Director Finances of the industry are CPAs. Whenever there is a choice between a CPA and a non-CPA to fill in a prestigious post, a CPA is always picked up because of the trustworthiness associated with the designation. According to the AICPA, CPAs earn 10-15% more than non-CPAs working in accounting-related jobs. Or you can look at it this way, a CPA has the potential to boost their earnings by $1 million over their lifetime compared to a non CPA in the same position. Here while talking about CPA, we mean the CPA US qualification provided by AICPA – as that is the most worldwide valued CPA designation in the business world.

However attractive the above sentences sound, do not take a decision in haste. Because behind every great prestige there is a greater dedication required.

The decision to become CPA US or a Certified Public Accountant, is absolutely a personal one – depending on your life and professional goals.

A CPA US is a licensed accountant who has:

- Passed a series of rigorous tests administered by the American Institute of Certified Public Accountants (AICPA)

- Completed 150 hours of coursework

- Worked at least one year in the accounting field under a licensed CPA.

While accountants can prepare detailed financial reports, audit the books of public companies, and prepare reports for tax purposes, only CPAs can legally sign tax returns and represent clients at tax audits or other matters by the IRS.

The CPA designation requires continual educational enhancement.

CPAs must complete 80 hours of Continuing Professional Education (CPE) every two years to keep their license current. In most states, the requirement includes a minimum number of accounting and auditing courses, as well as a board-approved ethics course.

It’s a commitment. Don’t do it just because someone tells you to. Do it because you want to do it and you want to make a lucrative future in the Public Accounting Domain.

CPAs need to be analytical and detail-oriented. They need good written and oral communication skills and good people handling skills.

And, they need to pass the four-part CPA exam. They also need to meet the eligibility requirement to write the exams.

CPA exam is conducted by American Institute of Certified Public Accountants (AICPA). NASBA represents the 50 State Board of Accountancy and 4 districts which determine the Exam eligibility of the candidates. Different states of the US have different sets of eligibility criteria and a CPA aspirant needs to be evaluated as eligible for a given state before writing for the exams from that state. The relevant State Board of Accountancy declares the Exam score. After passing the exam one needs to apply for the license from the respective State Board of Accountancy in case he wants to practise as a Chartered Accountant in the United States and some more first world countries.

ELIGIBILITY CHECK:

You need to send all your educational documents to an expert for the basic evaluation of your CPA eligibility before you go for an official evaluation by NASBA. You are eligible to write the exams if you possess a 4 years bachelor degree in commerce or you have a master in finance and accounting, you are the perfect candidate to give CPA a go.

MONTHS OF CPA EXAMS:

January & February: Testing Window

March: Dead Month

April & May: Testing Window

June: Dead Month

July & August: Testing Window

September: Dead Month

October & November: Test Window

December: Dead Month

Candidates are allowed to take all four sections of the exam during any testing window and in any order they choose. However, you may not take the same section more than once during any single testing window.

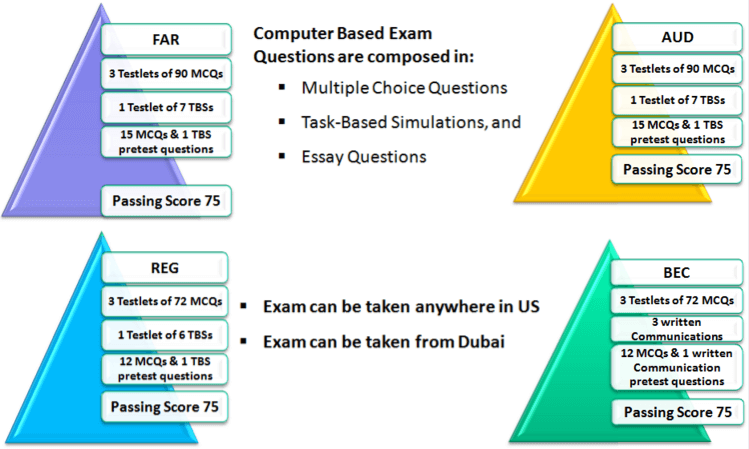

Exam Papers, Syllabus, Exam tenures and Exam structure:

- FAR(4 hour exam) 60% MCQ, 40% Simulations

- Financial Accounting & Reporting

- US GAAP & IFRS

2. AUD(4 hour exam) 60% MCQ, 40% Simulations

- Auditing & Attestation

- Auditing standards & procedures

- REG(3 hour exam) 60% MCQ, 40% Simulations

- Regulation

- US federal taxation & business law

- BEC(3 hours exam) 85% MCQ, 15% Written Communication Tasks

- Business Environment & Concepts

- Understanding business transactions

Countries where CPA Exams are conducted:

- Apart from the US, CPA exam is nowadays also conducted in countries like UAE, Bahrain, Kuwait and Lebanon. This has reduced the total cost of doing CPA by a significant amount for the Asian students.

For more details on CPA US, you may contact the writer at bhaswati@logiccpacma.com or check http://www.mylogic.online/cpa.html

Comments are closed.